Not known Facts About Mileagewise - Reconstructing Mileage Logs

Not known Facts About Mileagewise - Reconstructing Mileage Logs

Blog Article

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

Table of ContentsIndicators on Mileagewise - Reconstructing Mileage Logs You Need To KnowThe Best Guide To Mileagewise - Reconstructing Mileage LogsSome Known Details About Mileagewise - Reconstructing Mileage Logs The Greatest Guide To Mileagewise - Reconstructing Mileage LogsThe Best Guide To Mileagewise - Reconstructing Mileage LogsWhat Does Mileagewise - Reconstructing Mileage Logs Do?

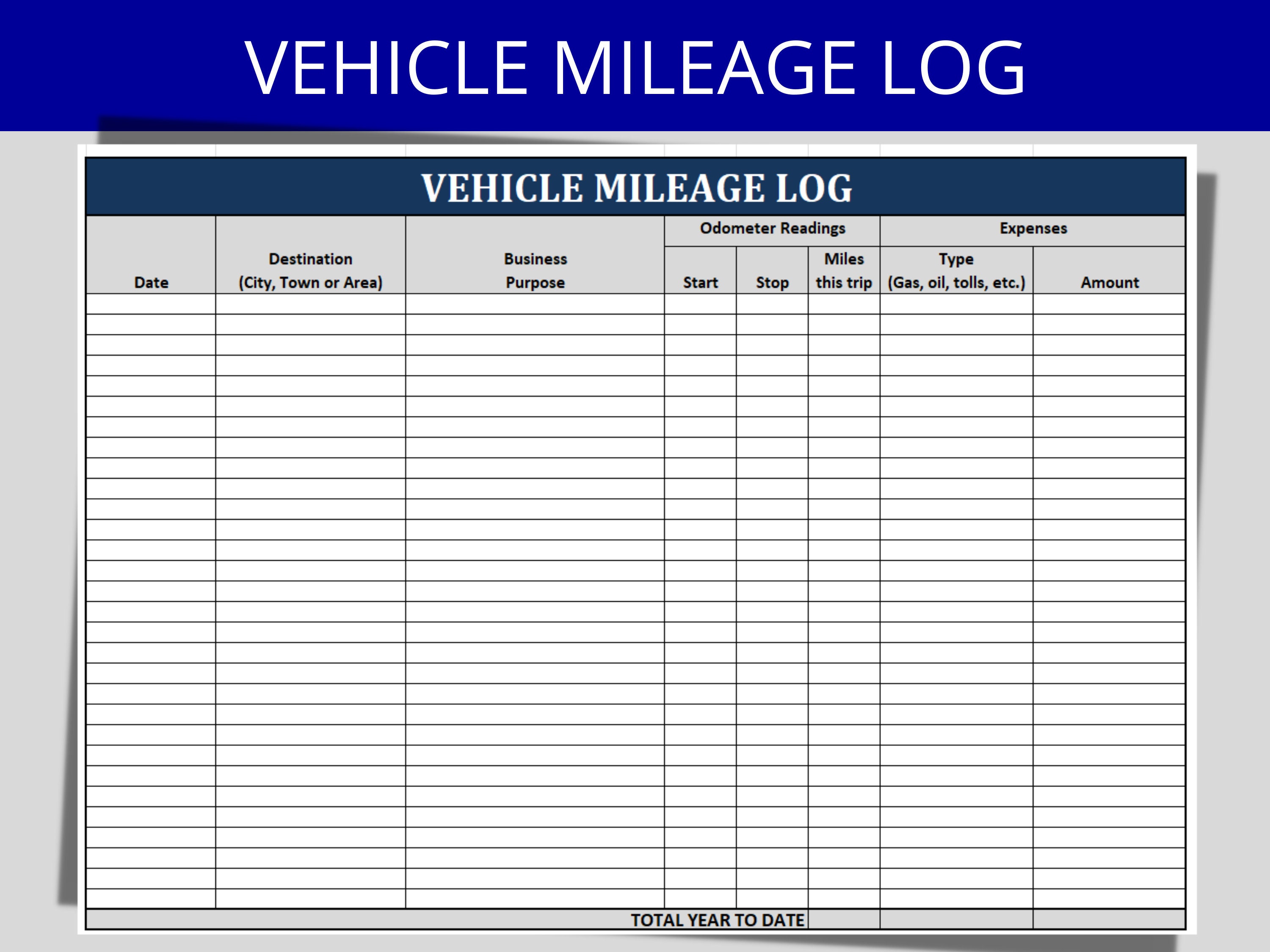

Workers won't receive their repayments unless they send mileage logs for their organization journeys. Second, as formerly mentioned, while manually taping mileage is an alternative, it's time consuming and reveals the company to mileage scams.While a normal gas mileage repayment can be run with hand-operated gas mileage monitoring, a FAVR program requires a business gas mileage tracker. The thinking is straightforward. FAVR compensations specify to every private driving worker. With the right service provider, these rates are computed via a platform that attaches service mileage trackers with the information that ensures fair and accurate gas mileage compensation.

This confirms the allowance quantity they get, guaranteeing any quantity they get, up to the IRS gas mileage price, is untaxed. This also shields companies from prospective mileage audit risk., also referred to as a fleet program, can't perhaps have need of an organization gas mileage tracker?

The Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

, "A staff member's individual use of an employer-owned automobile is considered a component of a worker's taxed revenue" So, what occurs if the employee does not keep a document of their service and personal miles?

A lot of company gas mileage trackers will certainly have a handful of these functions. At the end of the day, it's one of the most significant advantages a company gets when taking on a company gas mileage tracker.

Mileagewise - Reconstructing Mileage Logs for Beginners

(https://www.storeboard.com/mileagewise-reconstructingmileagelogs)If the tracker allows employees to send insufficient mileage logs, after that it isn't doing as needed. Some trackers just need one tap to record a day of service driving. Areas, times, odometer record, every one of that is logged without extra continue reading this input. The app will certainly even acknowledge when the lorry has actually stopped and finished the trip.

Mobile employees can include this details whenever before sending the mileage log. Or, if they taped a personal journey, they can remove it. Sending mileage logs with an organization mileage tracker ought to be a wind. When all the details has been added properly, with the most effective tracker, a mobile employee can submit the gas mileage log from anywhere.

Everything about Mileagewise - Reconstructing Mileage Logs

Can you think of if a company mileage tracker application caught every solitary journey? There's no damage in catching individual journeys. With the best gas mileage tracking application, companies can set their functioning hours.

The 4-Minute Rule for Mileagewise - Reconstructing Mileage Logs

It might come as no surprise to you that the Motus app is a core part of our car repayment remedies. This app works hand in hand with the Motus platform to guarantee the precision of each gas mileage log and repayment. So what are the features of the Motus App? Where does it stand in terms of the best mileage tracker? Let's have a look at some information complied by G2.

Intrigued in discovering more regarding the Motus app? Take an excursion of our application today!.

Indicators on Mileagewise - Reconstructing Mileage Logs You Need To Know

We took each application to the field on an identical course during our rigorous screening. We evaluated every tracking setting and changed off the internet mid-trip to attempt offline mode. Hands-on screening allowed us to analyze use and establish if the app was very easy or difficult for workers to use.

: Easy to useAutomatic gas mileage trackingMinimum tracking speed thresholdSegmented monitoring Easy to produce timesheet records and IRS-compliant gas mileage logsOffline mode: Advanced devices come as paid add-onsTimeero covers our listing, many thanks to its simplicity of usage and the efficiency with which it tracks gas mileage. You don't require to buy pricey gadgets. Simply request staff members to install the mobile application on their iphone or Android mobile phones which's it.

Report this page